Most people would agree that being in a motor vehicle accident is one of the most inconvenient but unfortunate circumstances to find yourself in. After an accident, the feeling of panic sets in, followed quickly by concerns about the condition of your car. The stress of potential vehicle damage often surfaces before drivers even realize they may have been injured.

If you have just experienced that feeling and have no idea what to do next, keep reading. We’ll provide you with everything you need to get through this difficult time.

- Immediate steps to take following a motor vehicle collision.

- How to file a property damage claim with an insurance company in New York.

- How property damage is paid for.

- Tips for maximizing property damage claims.

- Expectations during the insurance claims process.

- Responsibilities of the involved parties and the insurance company’s investigative process.

Step 1: Take a breath

Remember, cars can be fixed or replaced, but your safety and that of others is irreplaceable. After a motor vehicle collision, your priority should be to ensure everyone’s safety. Move your vehicle to a safe spot on the side of the road to prevent further damage. Once you’re in a secure location and have confirmed that no one requires immediate medical attention, you can start assessing the damage to your vehicle.

Step 2: Call 911

A police report is crucial for any insurance claim, as documenting the details and nature of the accident and obtaining witness statements at the scene can significantly influence the insurance company’s decision. Regardless, you are legally obligated to report most accidents in New York State. Section 605 of the New York State Vehicle and Traffic Law says that if any person is injured or property damage to either vehicle exceeds $1,000, a crash report (MV-104) must be filed within ten (10) days of the accident.

Police response is the best way to ensure you receive the other driver’s accurate insurance information. The responding officer should provide you with an Accident Exchange form detailing the other driver’s information for temporary use. The full report can take a few days to be completed.

Step 3: Get evaluated by a medical professional

Injuries sustained from car accidents have a unique way of presenting. Many people do not feel extreme pain or notice visible physical trauma immediately following the accident, but it is critical to get evaluated regardless. It is not uncommon for people to learn that they have significant trauma for several days, sometimes weeks, following an accident, most notably for soft tissue injuries.

Step 4: Document everything

Take pictures of everything. You will want to provide photos of all vehicles involved, whether damaged or not, and the surrounding area at the very least. Photos and videos paint a clear picture for the insurance company and could expedite their determination. Something like a dented garbage tote may seem irrelevant, but it could substantiate your statement.

Step 5: Call Richmond Vona

Not sure if you suffered an injury from your accident, but want to speak with someone before you jump into the claims process? That’s okay. We are here to listen and guide you through this difficult time. If you have been injured in a car accident and aren’t sure of what to do next, you should certainly call us. And if you are still trying to figure out if your pain is worth seeking medical or legal advice, we help you with that, too.

We can advise you from the hospital waiting room or three weeks later if you didn’t shake off that pain in your shoulder as you anticipated.

If you skip this step, keep reading to learn the ins and outs of filing an insurance claim and how to best navigate the process. If you do call our firm, we will take it from here for the most part.

Step 6: Get your insurance company on the phone

Call your insurance company as soon as you and the scene are secured. Provide the insurance representative with as much detail as possible. They will want all the accident information and any evidence you gathered from the scene (photos, the accident exchange form from the police). If your insurance policy includes rental reimbursement, ask to start that process.

Filing a Claim Online

Most insurance companies provide an option to report a claim online, whether the company insures you or not. One of the first questions should be whether you are a policyholder or if you were in an accident with a driver who is.

Additionally, they will likely ask for:

- The type of claim

- The date & time of the accident

- The location of the accident

- A description of the accident

- Contact information for others involved

- The status of the vehicle(s) involved

- Vehicle owner information

- Police report status/details

While having all this in your initial reporting is great, claims can always be updated as more information becomes available.

Tips for Maximizing Property Damage Claims

- Keep thorough records of all communications with the insurance company, including dates, names of representatives, and details of conversations;

- Take inventory of all damaged items;

- Request a reassessment when necessary;

- Hire an independent appraiser;

- File a complaint with the insurance company if not presented with a fair offer; and Consult with an attorney.

Common Property Damage Claim FAQs

What Can I Claim as Property Damage After a Crash In NY?

Insurance companies cover damages to various items in addition to your vehicle affected by a crash. For example, there are many personal items people carry with them while driving, such as cell phones and even pets. Personal property damage could be severe if someone were to get into a crash while they were moving. In these situations, it’s best to compile receipts for your personal items to provide the insurance company with quick proof of ownership and the value of the items.

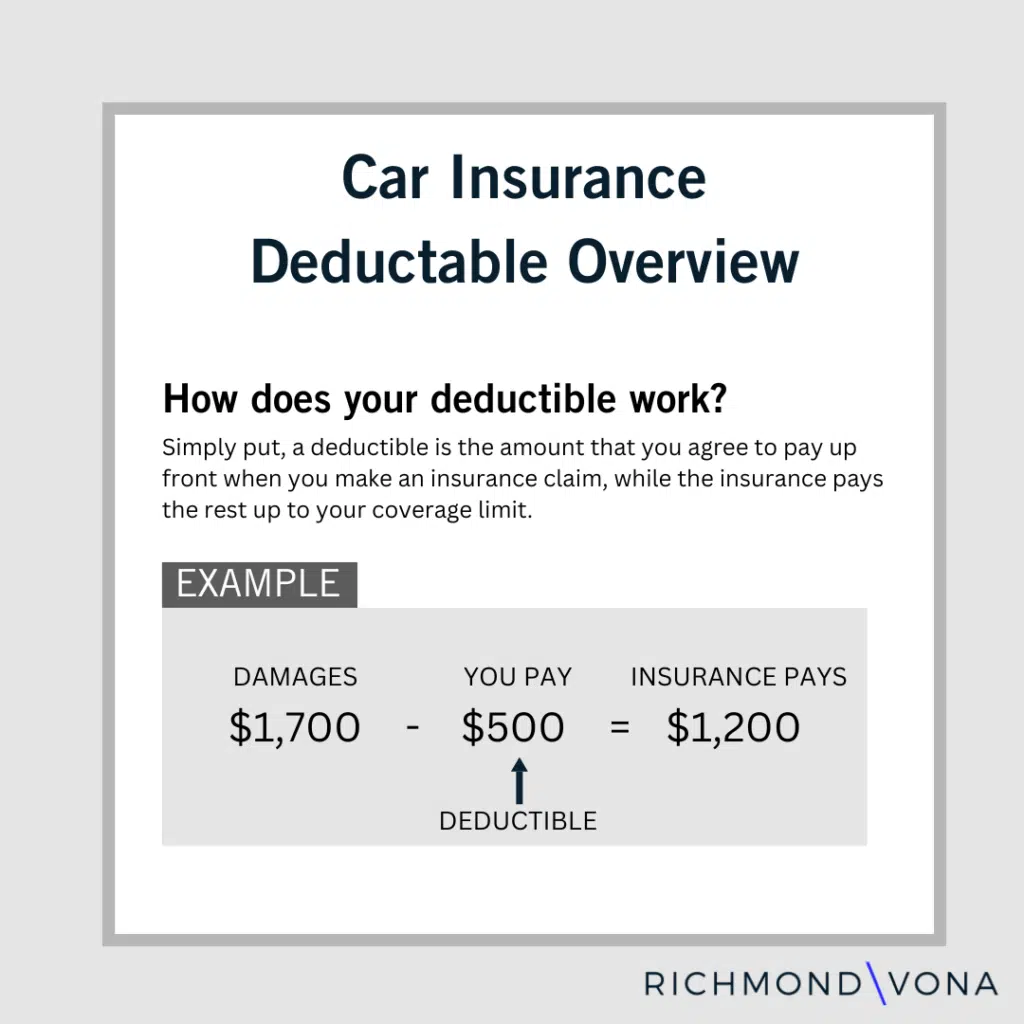

Who Is Paying for The Damage to My Car?

Perhaps the most critical question to be answered. The party responsible for paying for the damage to your car depends on the nature of the collision.

If you were at fault, clearly and admittedly:

Your insurance company will be responsible for covering the cost of your car repairs. The minimum car insurance coverage for property damage in NYS is $10,000. Therefore, if you have the lowest required to save a few extra bucks on your premium, you could be in an unfortunate situation if the damages exceed that amount.

If the other drive was at fault:

Their insurance company is responsible.

It is not always clear cut, however, which insurance company is liable. In the simplest of scenarios, one driver admits to being at fault, and the assigned insurance adjuster won’t have much work to do. In many cases, however, there is either a dispute of liability or the insurance company wants to do their due diligence to ensure their driver was the one who caused the collision and the subsequent damage

So, What Happens with My Car After Filing a Claim?

Once you have notified the insurance company of the collision, they will begin their investigation. Preliminary actions typically include getting the claim into the system and obtaining evidence and details from sources, including you. Your claim will then be assigned to an insurance adjuster, who will become your point of contact throughout the claim until it is completed.

Every insurance company has its own policies and procedures, but they all act similarly. You will need to obtain estimates from auto repair shops. Some insurance companies require estimates from repair shops of their choice; some may ask that you present them with several estimates from different places. Either way, you will likely have to submit an estimate for them to cover the cost.

Once an adjuster is assigned, depending on the severity of the damage and the value of the vehicle, they may schedule a time to assess the damages themselves. Once the adjuster reviews the repair estimates and completes their own damage assessment, the insurance company will submit an offer to you.

How Do I Know If What the Insurance Company Has Offered for the Property Damage Is Fair?

Compare the amount offered to the repair estimates you received. Will it cover the damages in full? Do you understand the deductions or deductibles applied? Be sure to have all your questions answered by the insurance company before accepting. If the amount offered is not reasonable (especially if you feel it may not cover the total cost of the repairs), you can negotiate with further argument and evidence.

If you determine the settlement offer is fair and will cover the repairs fully, the next step is to schedule a time to fix your car. Do your research and select a reputable auto repair shop. Once the work has been completed, keep all receipts and summaries of repair for your records. It is best practice to always save all repair summaries from auto shops in your glove box.

What Happens If the Other Driver's Insurance Policy Doesn't Cover the Cost?

Unfortunately, $10,000 is the minimum required by law. So, if the other driver has that minimum coverage and your property damage exceeds it, you may not be able to do much. However, if your insurance company determines that you were slightly liable for the collision, your coverage could be used to cover the difference or some of what’s left over.

What If I Can't Get to A Fair Resolution with the Insurance Company?

Consider seeking legal advice for car damage after a crash if you encounter challenges such as disputes over the claim amount or delays. Legal professionals can help you navigate communications with the insurance company and protect your rights.

If You Have Property Damage Claim Questions, We're Here To Help

Filing a property damage claim after a car accident doesn’t have to be daunting. By following these steps and staying organized, you can ensure you receive the compensation you’re entitled to. Prioritize safety, report everything thoroughly, and work closely with the insurance company for a smoother process. If you encounter difficulties, don’t hesitate to seek professional legal advice to protect your interests.

Richmond Vona is a New York Personal Injury law firm with offices in Buffalo, Niagara Falls, Williamsville, and Rochester, dedicated to fighting for those injured due to the negligence of others. For more information, please fill out our online contact form or call us at 716-600-HURT.